Probate Court Fees set to increase from May 2024

Since November 2023, it has been confirmed by the Ministry of Justice that most court fees will be increased by 10%. It has now been decided that from May 2024, the standard Probate Fee is set to increase from £273 to £300.

What is Probate?

Probate is the process of administering a deceased person’s estate which generally involves paying any debts and taxes, organising and distributing the deceased’s assets and dealing with their possessions and property. A Grant of Probate is usually required to confirm the Executors are legally entitled to deal with a deceased person’s assets for the purposes of closing down bank accounts or selling a property.

Why are the Probate Fees going up?

The reason for the increase has been confirmed as follows:-

- “intention to recover the cost to HMCTS of providing its services from those users who are able to afford a fee”; and

- “the additional income raised from an increased probate fee will contribute towards the continued improvement of service delivery.”

It is noted that these improvements will relate to recruitment of more staff in order to increase the number of Grants that will be processed.

The increase is an extra £27 following the last Probate Fee rise that occurred from 26 January 2022.

What Probate Applications are going to be affected?

Only Probate Applications with estates of over £5,000 as standard will have to pay Probate Fees. These fees are usually recoverable from the estate following a Grant of Probate.

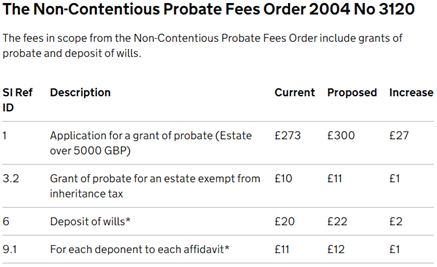

The following table highlights the full extent of the fee increase for Probate:-

What does this mean for you and how can Ellis Jones help?

We hope that the rise in fees will lead to an increase in resources that should help towards tackling the current, very significant Probate application delays meaning that estates can be dealt with much more efficiently and quickly to enable us to better assist our clients.

If you need any assistance or advice in relation to Probate, please do not hesitate to get in contact with our Wills, Trusts and Probate Team on 01202 525333 or email wills@ellisjones.co.uk.

About the authors

Georgie is a Trainee Solicitor and is currently gaining experience within out Wills, Trusts & Probate team based in the Canford Cliffs office.

Carla is a Partner, Solicitor and the Head of our Wills, Trusts & Probate team and is based in Canford Cliffs. Carla was listed as a recommended lawyer in The Legal 500 UK 2024 for Wills, Trusts & Probate – “exceptional in her knowledge and client care. She is not afraid to tackle complex technical and family matters. I would never hesitate to recommend Carla to my clients.”

How can we help?

When you submit this form an email will be sent to the relevant department who will contact you within 48 hours. If you require urgent advice please call 01202 525333.